|

''P2P RISK SHARING" END OF INSURANCE AS WE KNOW IT

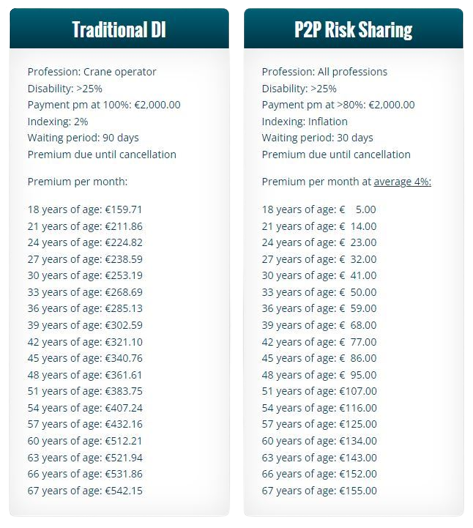

Risk Sharing without the traditional costs ±30%, taxes ±20%, and profits ±10%

So at least with 60% lower Premiums

Explore

|

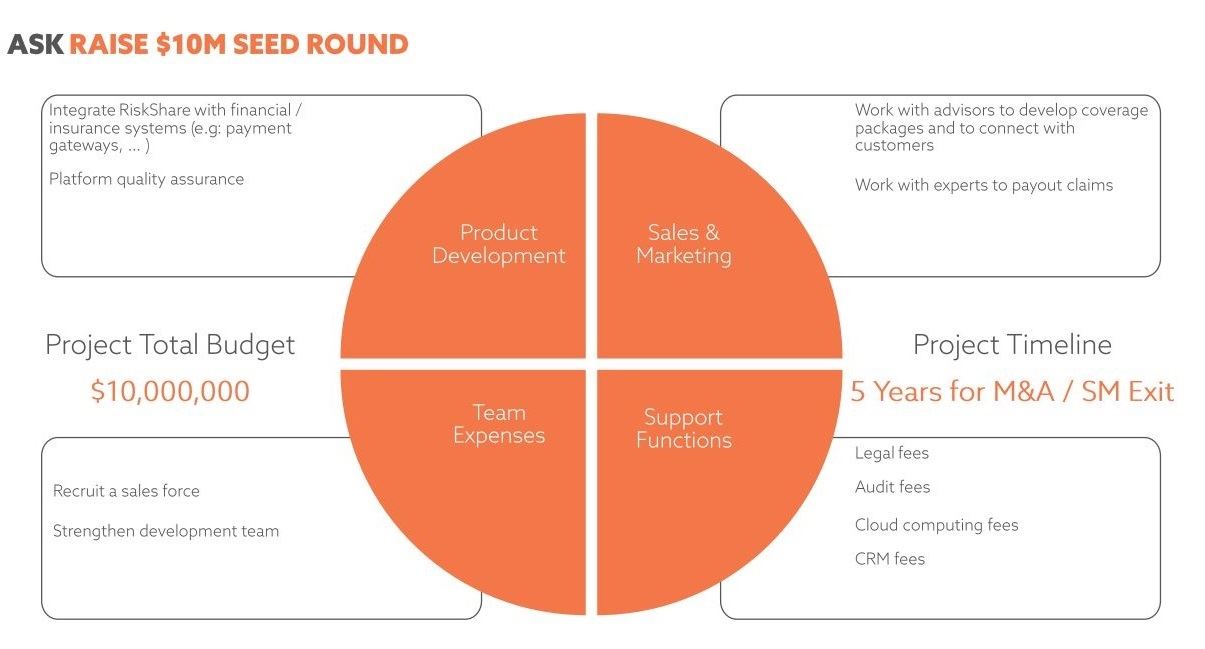

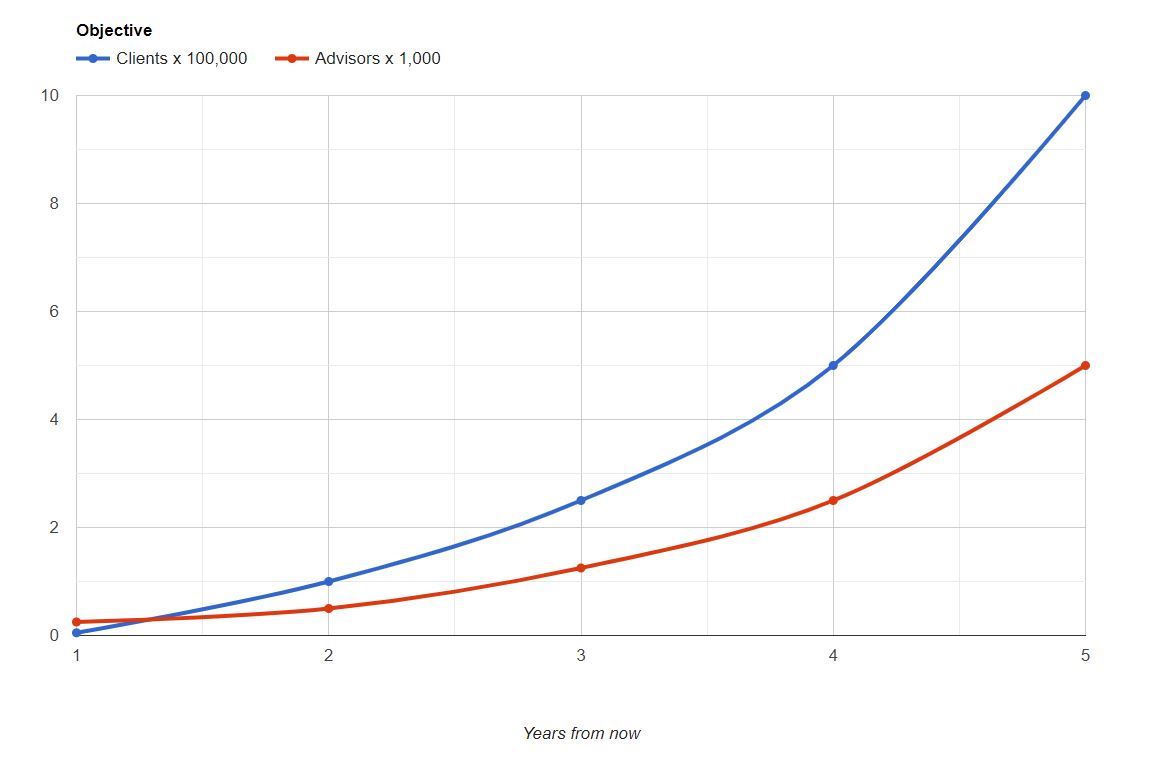

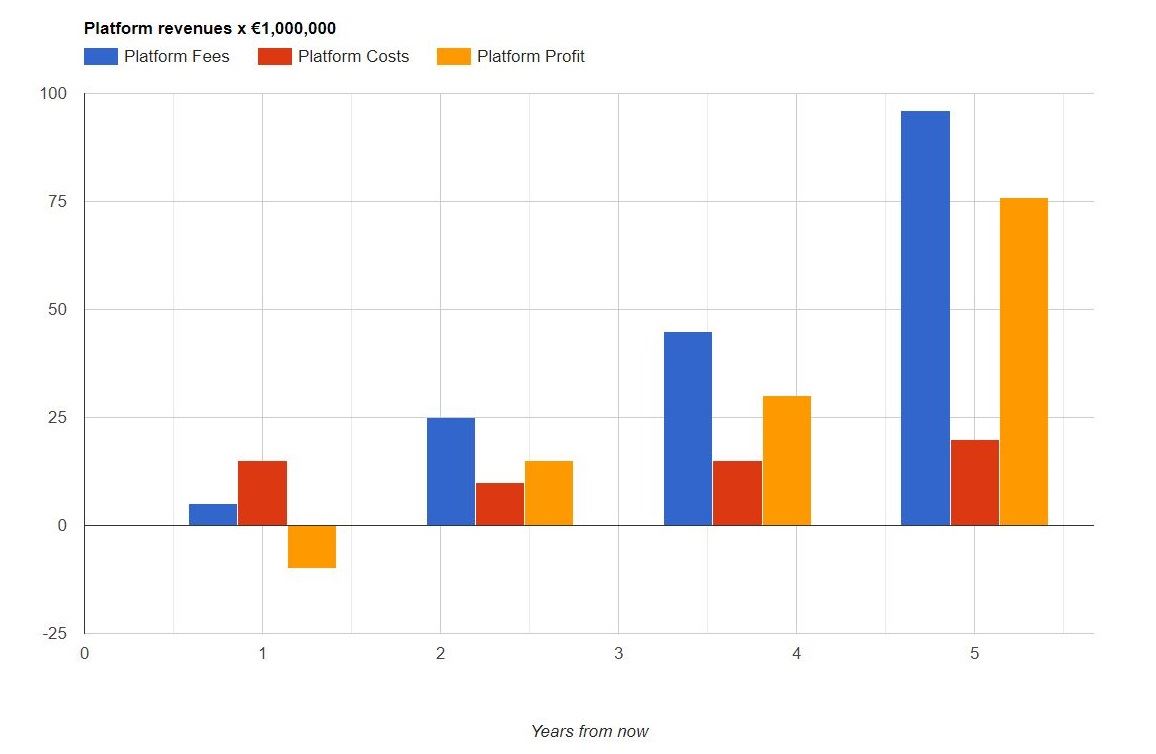

I am Remmelt Bossema, the founder of RiskShare, a groundbreaking insurtech startup poised to reshape the landscape of insurance. We are looking for a born entrepreneur who embodies the entrepreneurial spirit of visionaries like Travis Kalanick (Uber) and Brian Chesky (Airbnb). Together, we can propel RiskShare to heights previously unseen in the insurtech realm. RiskShare is not just another startup; it is destined to become a UNICORN within a mere 5 years from now! Imagine being part of a journey that transcends industry norms, redefines the concept of risk sharing, and catapults us to a market value of 1 billion euros. This isn't just a venture; it's a revolution waiting to happen. With an initial investment of 10 million euros in seed capital or convertible loan(s), RiskShare is set to revolutionize the market with the world's first and only true p2p risk sharing platform. Our strategy is simple yet powerful – emphasizing organic growth, high profitability, and eliminating the specter of loss and insolvency through secure p2p risk bearing. We invite you to join us in this exhilarating venture, where the power of ideas meets the potential to impact the world. RiskShare is a phenomenon waiting to be unleashed. Together, let's not only surpass the success of Uber and Airbnb but redefine the very essence of success in the insurtech universe. Seize the opportunity, embrace the challenge, and let's make RiskShare the UNICORN that disrupts and dominates the insurtech world within the next 5 years. The stage is set, and the time is now!

RiskShare is the world's first and only true peer-to-peer risk sharing platform. On this platform, participants only pay for each other's claims without the intervention of an insurer or reinsurer, resulting in average savings of ±30% in costs, ±20% in taxes, and ±10% in profits. As a result, risk sharing payments worldwide are at least 60% lower than premiums for traditional insurance. Participants pay only a periodic variable amount. No payments and refunds before and after. RiskShare means, 'the sharing of claims paid per day, by the new and renewing participants on that day'. RiskShare is an online network of participants and thus has no expensive buildings, directors, or staff, resulting in a lack of bureaucracy. RiskShare offers coverage for death, disability, accidents, healthcare, travel, liability, legal aid, damage or loss to car, house and contents. RiskShare taglines: "Risk ends where RiskShare begins". "Caring connects us All". "A Circle of care that never Ends". "Where care knows no Limits". "You're never alone with RiskShare", "We all take care of You - You all take care of Me".

BIGGER THAN UBER AN AIRBNB The premium volume in the insurance industry amounts yearly to no less than 7000 billion euros worldwide. Many times larger than the cab industry 200 billion and the hotel industry 1000 billion in which Uber and Airbnb disruptively excel. This makes it remarkable that disruption has so far remained absent from the insurance sector. However, there is now 'RiskShare'. A P2P risk sharing platform with mutually agreed terms and at least 60% lower premiums advised and managed by independent advisors. Every person and every family all over the world needs protection from financial risk. RiskShare puts P2P risk sharing at your fingertips anywhere in the world with nothing more than smartphone and internet. RiskShare will become bigger, more agile and more profitable than Uber and Airbnb with the right man or woman at the top.

GLOBAL SHARING PLATFORMS

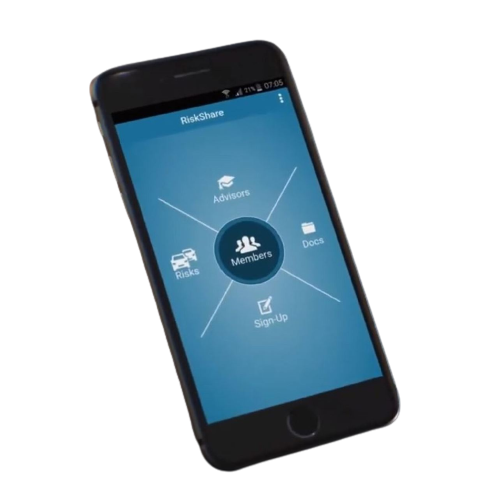

ADVISORS ARE THE KEY RiskShare is advised and managed by independent financial, tax, legal and medical advisors. The advisors build their own client base through subscriptions and determine the amount of the subscriptions themselves e.g. €50 p.m. They are the first and only point of contact for advice and claims and thus client responsible. Advisors represent not only the interests of their individual clients through prompt claims settlement, but also the interests of all their clients for low risk sharing payments through fair claims settlement. By doing so, the advisors are the equivalent of the front and back office of a traditional insurer. All this makes RiskShare highly digital and highly personal. This approach allows advisors to work based on their personal ambition and emotion, while considering their strengths and weaknesses and maintaining a healthy balance between work and personal life. NO REGULATIONS AND LICENSES APPLY Entities without legal status encompass organizations and groups that lack legal rights and obligations. This classification includes informal clubs, partnerships, associations, and online networks of individuals. While traditional insurance companies operate within a regulated framework, a P2P risk sharing network, like RiskShare, does not fall under the purview of such regulations. And risk sharing is not a product therefore not bound by licenses. RiskShare Networks acting as a risk carriers by distributing risk among its participants rather than relying on a single entity, like an insurance company. RiskShare Networks do not generate profits because they operate as a collective of individuals. In essence, RiskShare operates outside the boundaries of the traditional insurance industry and offers an alternative approach to insurance through P2P risk sharing networks.

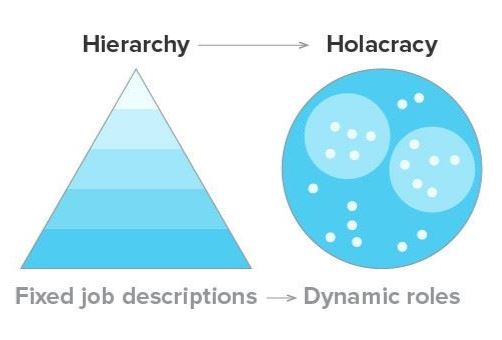

BUSINESS MODEL RiskShare consists of a group of 3 local risk sharing entities that are legally independent but economically inseparable. RiskShare forms a decentralized ecosystem of holacracy without bureaucracy. The model is technically straightforward, but demanding to launch.

3 LOCAL RISK SHARING ENTITIES 'RiskShare Network' are local risk sharing networks without a legal status that provides members a place to unite, cooperate, and share risks and resources. By engaging in collective risk management, members can mitigate individual exposures and establish a resilient framework for handling risks sustainable. 'RiskShare Advisors' are local franchise partnerships whose advisors provide valuable guidance and support to their network clients. They identifying and analyzing risks and developing effective strategies for risk management. Through continuous support, the advisors empower their clients to make well-informed decisions. 'RiskShare Platform' operates as a local SaaS tool, providing advanced technology solutions to network participants and risk advisors. The platform provides them with tools for sharing, managing and reporting risk, while also enabling seamless communication between all parties involved. HOW IT WORKS

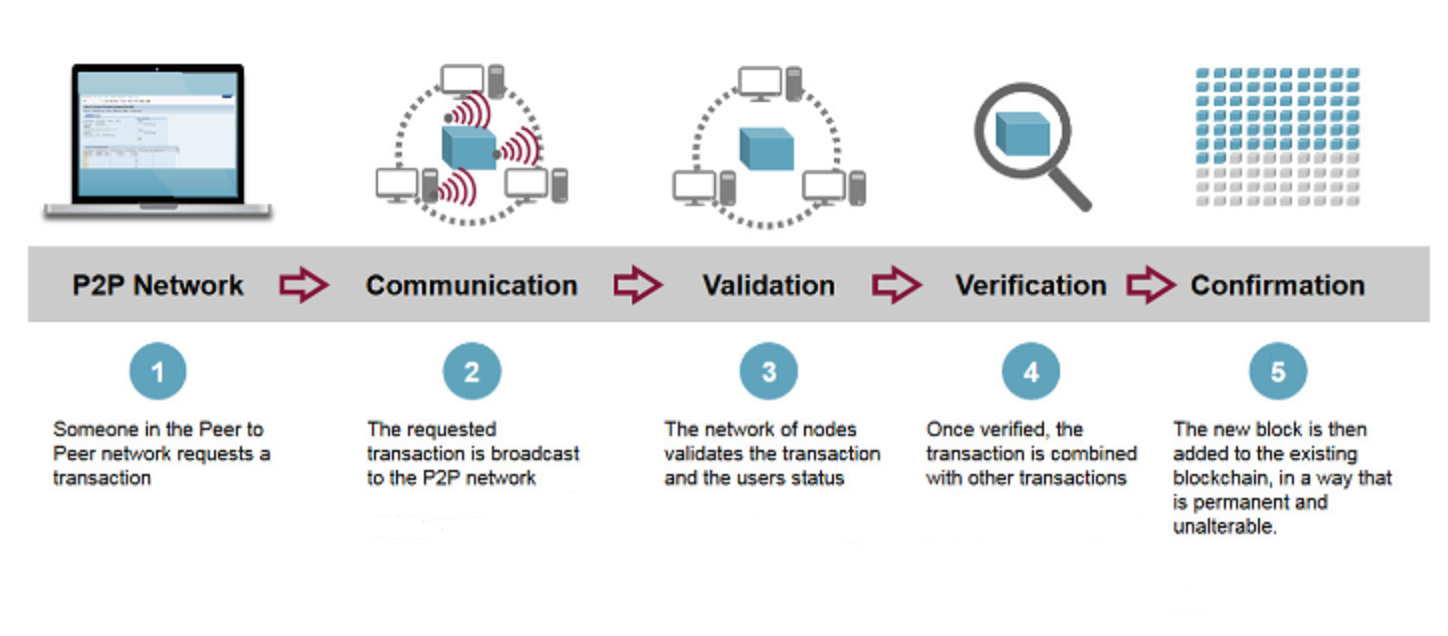

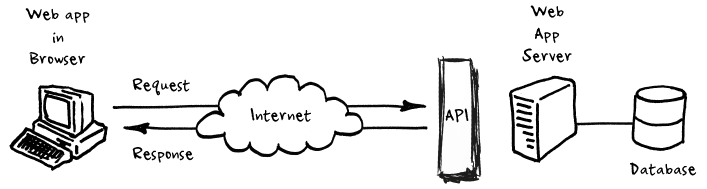

RISK SHARING PAYMENTS 96% of all transactions involve the collection of risk sharing payments. RiskShare has a fully automatic collection process. After in the RiskShare app the payment calculation and closing or cancellation is completed, participant is forwarded to PayPal that fully automatic handles the direct debit or cancellation. The details of all payment transactions are verifiably stored on the private blockchain. This process offers maximum scalability to grow exponentially to many millions of participants and transactions without the additional deployment of manpower and systems. RISK SHARING CLAIMS 4% of all transactions involve payments to claims. Participant reports the claim via AI to his/her advisor. Advisor and expert assess the claim. Expert creates a payment link. Advisor approves the link. Participant agrees to the claim settlement by activating the link and transferring the claim payment to his/her PayPal account. The risk sharing payments are, for each scheme, automatically recalculated daily, to cover claims paid on that day. At the end of each day, the balance of payments received and claims paid is zero. All claim transactions are verifiable stored on the private blockchain. PAYPAL FOR MAXIMUM SCALABILITY PayPal is an essential component of RiskShare's operational processes, as it enables the efficient and secure collection of subscriptions, the collection of risk sharing payments, and the payment of claims. The fully automatic collection and paying process allows for maximum scalability, handling many millions of transactions without the need for additional manpower and systems. Additionally, the use of a private blockchain ensures that all transaction details are verifiable and secure. Overall, PayPal plays a critical role in the efficient and streamlined operation of the RiskShare platform. |